- The Basic Idea of the Multiplier

- The Size of the Multiplier

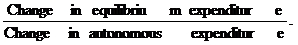

Multiplier =

- Why is the Multiplier Greater Than 1?

- The multiplier is greater than 1 because an increase in autonomous expenditure induces further increases in aggregate expenditure—induced expenditure increases.

- The Multiplier and the MPC

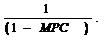

- The greater the marginal propensity to consume, the larger is the multiplier. Ignoring the effects of imports and income taxes, the multiplier equals

- Imports and Income Taxes

- The larger is the marginal propensity to import and the larger is the marginal tax rate (the fraction of a change in real GDP that is paid in income taxes), the smaller is the multiplier.

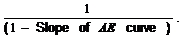

- The general formula for the multiplier is

Multiplier =

- Business-Cycle Turning Points

- The forces that bring business-cycle turning points are the swings in autonomous expenditure such as investment and exports. The mechanism that gives momentum to the economy’s new direction is the multiplier.

Be the first to comment on "The Expenditure Multiplier"