Image Source: http://hoileongchan.blogspot.in/2012/07/absorption-vs-variable-costing-critical.html

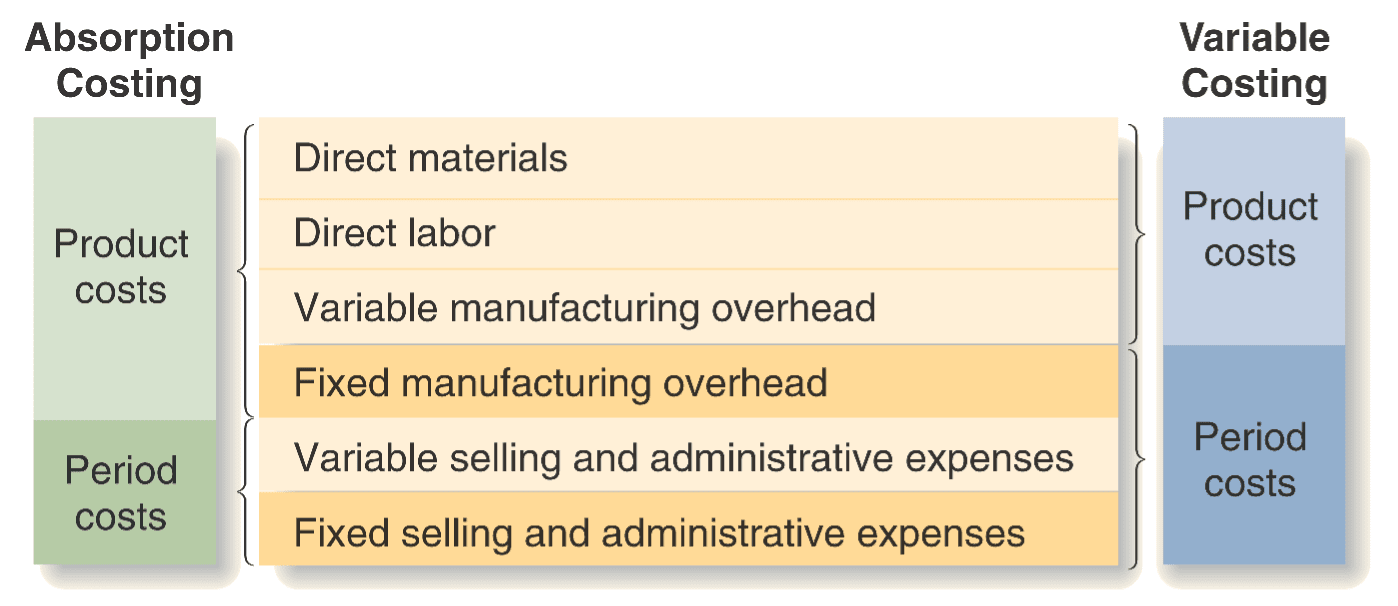

Variable Costing (CM Approach)

Only variable costs of production are charged to WIP and expensed via COGS when the goods are sold (includes DM, DL, and variable MO).

However, fixed MO is treated as an operating expense and is not charged to WIP.

Instead, it is expensed in the period the cost is incurred. Therefore, all fixed MO is expensed each period regardless of the level of sales.

Absorption Costing (Traditional Approach)

Under this method, all costs of production including fixed MO are charged to WIP and expensed only when the goods are sold via the COGS account. Therefore, the fixed MO relating to units still in ending inventory at the year-end is not expensed until a later period when the goods are sold.

Therefore, net income can differ between the two methods because of the treatment of fixed MO. It is expensed in full under the Variable costing method. However under Absorption Costing, it is split between COGS (which means part ends up on the income statement) and ending inventory (which means part ends up on the Balance Sheet)

Income Effect on Both Methods Relative to the Levels of Sales and Production

If Sales = Production, then net income under both methods is the same.

If inventory levels are rising, (i.e., production is > sales), only part of the fixed MO will be expensed under absorption (relating to the units sold). The fixed MO relating to the unsold units still in ending inventory will remain on the Balance Sheet until a later period when the units are sold. However, under Variable Costing, all the fixed MO is expensed in the period it is incurred regardless of the level of sales. Therefore, total production expenses will be lower and net income higher under Absorption costing.

If inventory levels are falling (i.e., sales are greater than production), all the fixed overhead from the beginning inventory plus a significant portion from current production will be expensed via COGS under absorption costing. However, under variable costing, the most fixed overhead that can be expensed in a period is the amount actually incurred in that period. Therefore, total production costs expensed will be higher under absorption costing and net income will be lower.

Be the first to comment on "Income Difference – Variable and Absorption Costing"